Generating a healthy passive income is about more than just buying shares with big dividend yields.

If I want to make a healthy extra income for life I need companies that will pay decent dividends over the long term. I also need to find stocks that grow dividends over time to offset the impact of rising inflation.

Here are two top dividend growers from the FTSE 100 I’ve bought for my own shares portfolio.

Should you invest £1,000 in Bunzl Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Bunzl Plc made the list?

Bunzl

Like many support services businesses, Bunzl (LSE: BNZL) is brilliantly boring. Its products aren’t sexy but they are essential in the modern world.

This gives the company exceptional profits robustness and thus the ability to raise dividends year after year. It’s raised shareholder payouts for the past 29 years on the spin in fact.

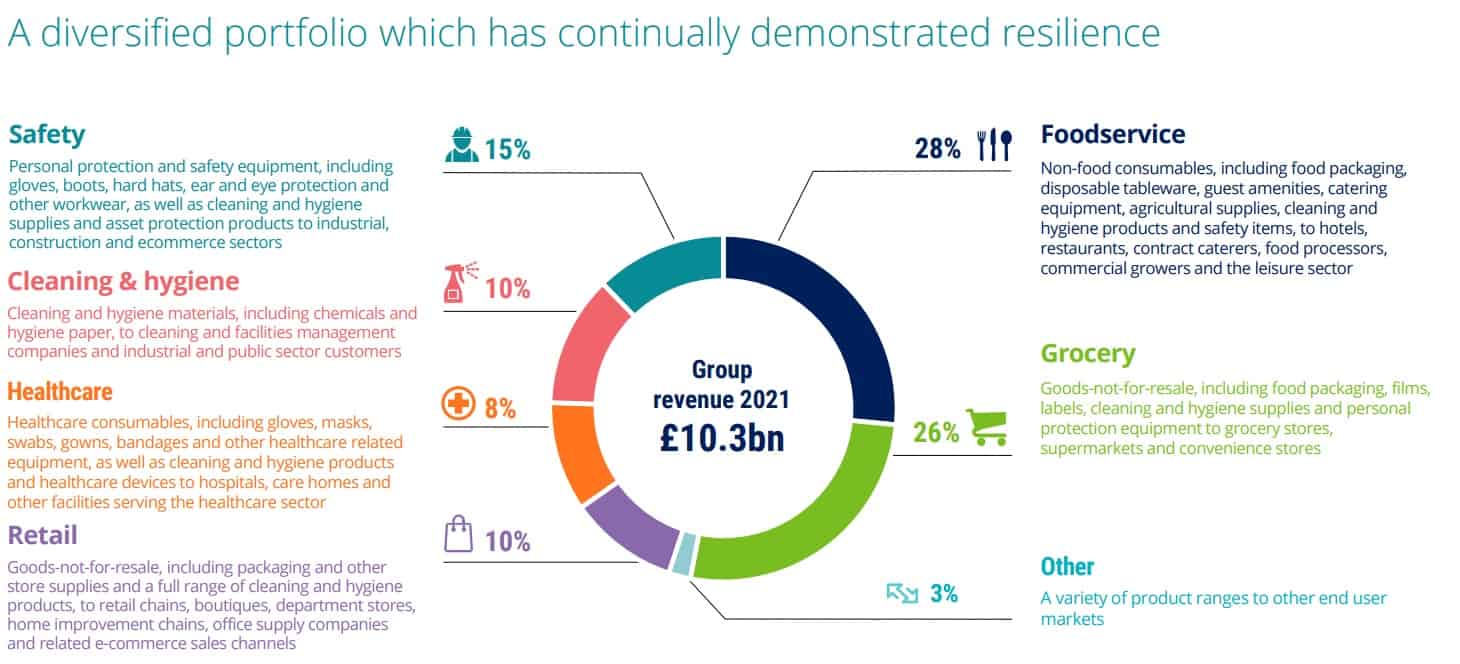

Bunzl’s operations are also highly diversified, giving profits generation an extra layer of security. It generates two-thirds of profits from North America but also has operations in Europe, Latin America, and Asia. And it is protected from weakness in one or two key industries by selling its products across a variety of sectors.

I also like Bunzl because of its commitment to growth through acquisitions. This does, however, create danger for investors as bad M&A decisions can erode shareholder value.

But the company’s track record on this front is exceptional. Clever targeting and asset integration has driven pre-tax profits 46% higher in just the past five years.

Bunzl has plenty more financial headroom to continue with profits-boosting acquisitions, too. Its net debt to EBIDTA ratio stood at 1.6 times as of June. This is well below the benchmark of three times at which things start to look stretched.

Ashtead Group

Fellow FTSE 100 share Ashtead Group (LSE: AHT) isn’t as geographically diversified as Bunzl. In fact it makes more than four-fifths of revenues from its US marketplace.

It also doesn’t provide services across multiple industries. It generates the lion’s share of profits from renting out heavy equipment like cranes, diggers, and air compressors. As a consequence it is vulnerable to downturns in the construction and industrial sectors.

However, its drive to build market share over the past decade has allowed it to keep growing profits (and thus dividends) regularly. In fact, Ashtead provided the best returns of any Footsie-listed stock during the 2010s.

Like Bunzl, Ashtead has a brilliant track record when it comes to mergers and acquisitions. It’s what makes the company the second-biggest player in the US today (it commands a 12% share of the market, not far behind first-placed United Rentals).

And Ashtead also has no signs of slowing down here. It spent $337m on 12 bolt-on acquisitions between April and July alone, and dedicated a further $699 to organic investment.

The US is tipped to embark on a construction boom over the next decade. This is likely to be driven in part by upgrades to the country’s aged infrastructure. And Ashtead is putting itself in the box seat to exploit this opportunity through steady expansion.